Short sell margin calculator

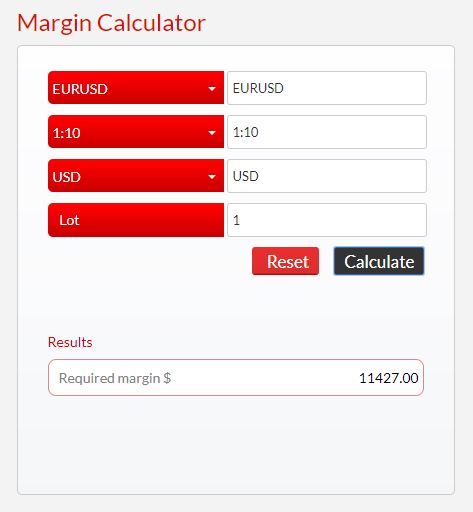

Create your portfolio and see exactly how much margin money is required to construct it. Rates subject to change.

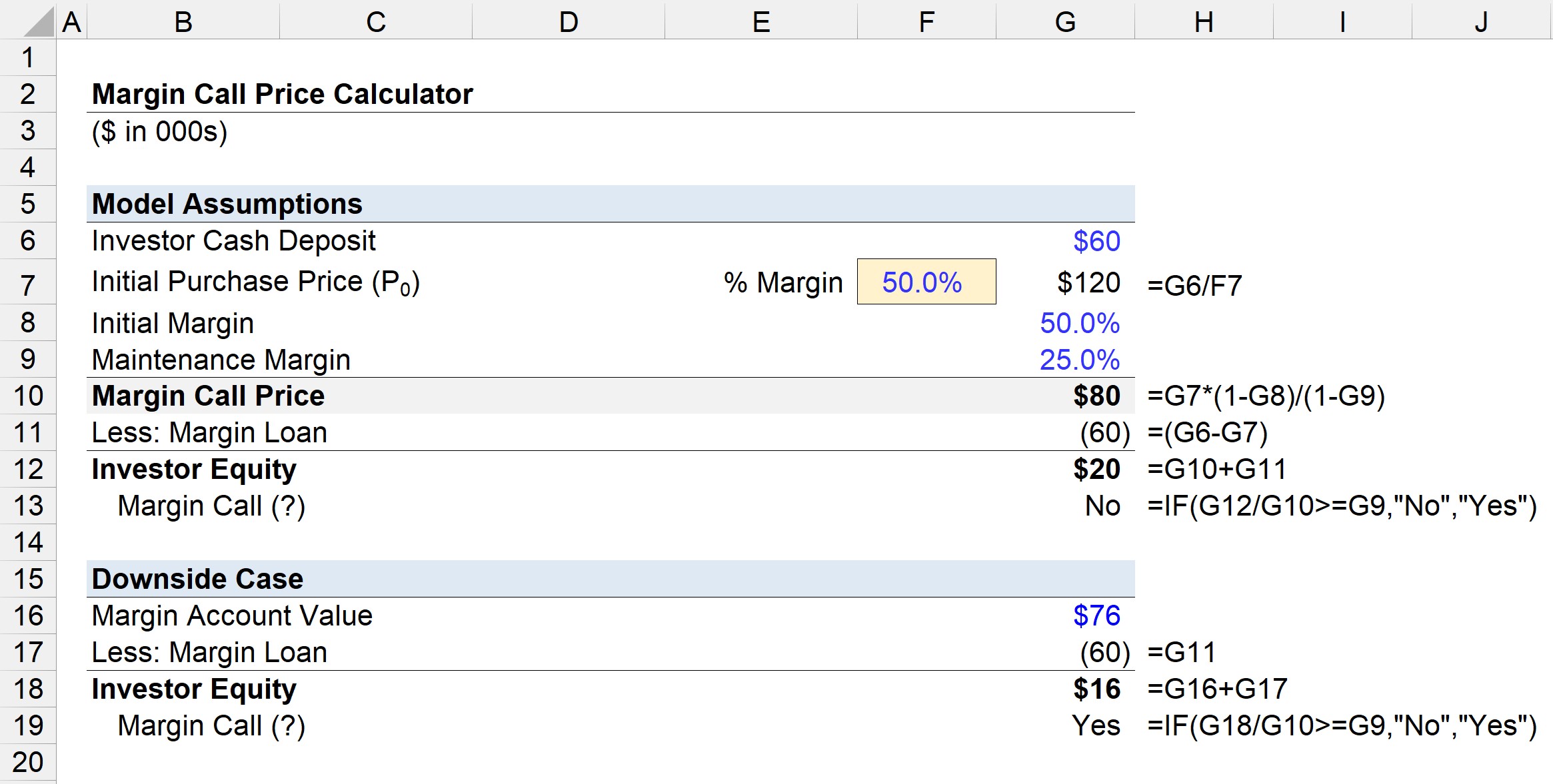

Margin Call Calculator

Stock Cost Profit and Loss Calculator.

. You open a margin account and deposit 5000. Get started by selecting a stock. We cannot calculate available margin based on the values you entered.

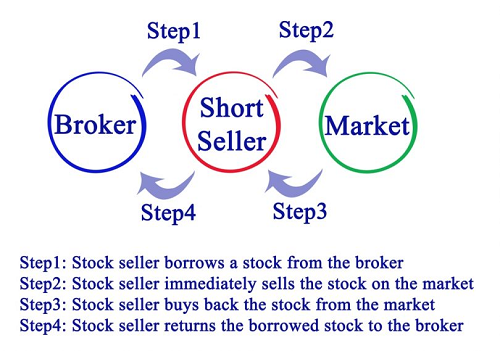

Margin borrowing lets you leverage securities you already own to purchase additional securities sell securities short protect your account from overdraft or. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for. Margin and Selling Short.

Your Total Portfolio Value for a Portfolio Margin account must be at least 100000. Short selling is the practice whereby equity and non-equity market participants sell securities they do not own with a view of buying them back. The margin call calculator exactly as you see it above is 100 free for you to use.

Margin borrowing lets you leverage securities you already own to purchase additional securities sell securities short protect your account from overdraft or. In technical terms leverage is the ratio between the amount of money you have in your account and the total size of positions the. It can also be calculated as net income divided.

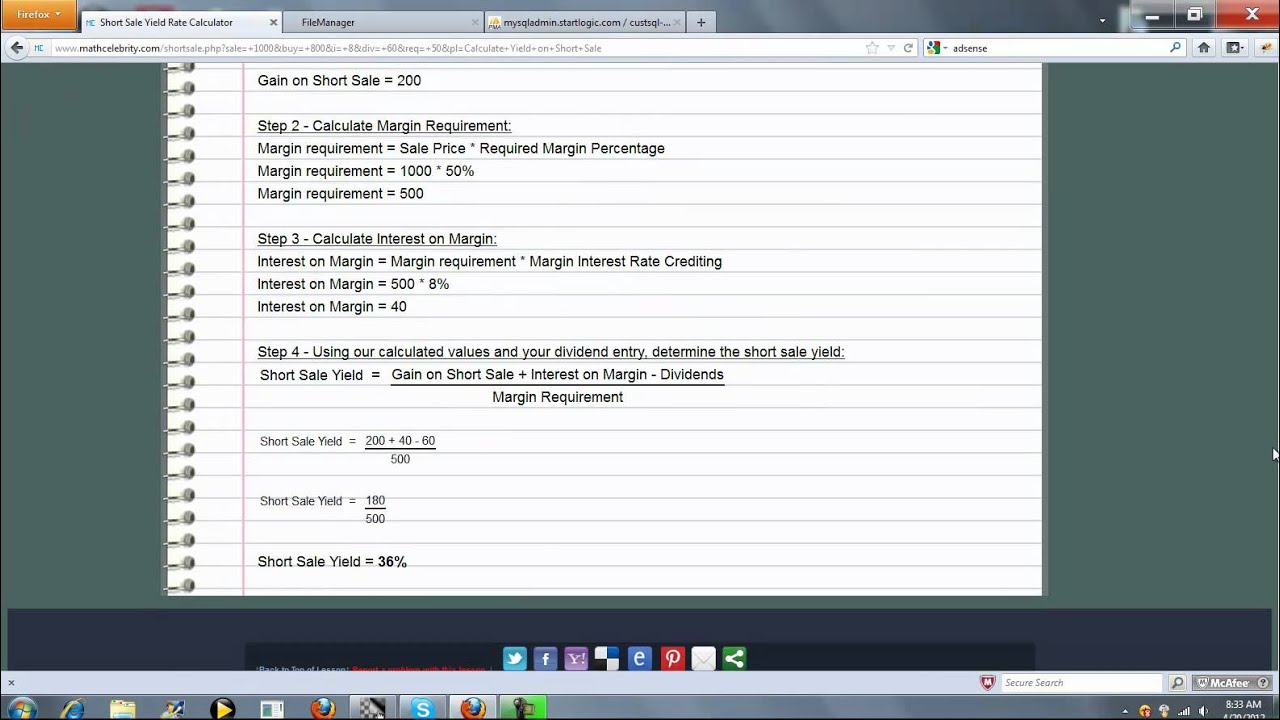

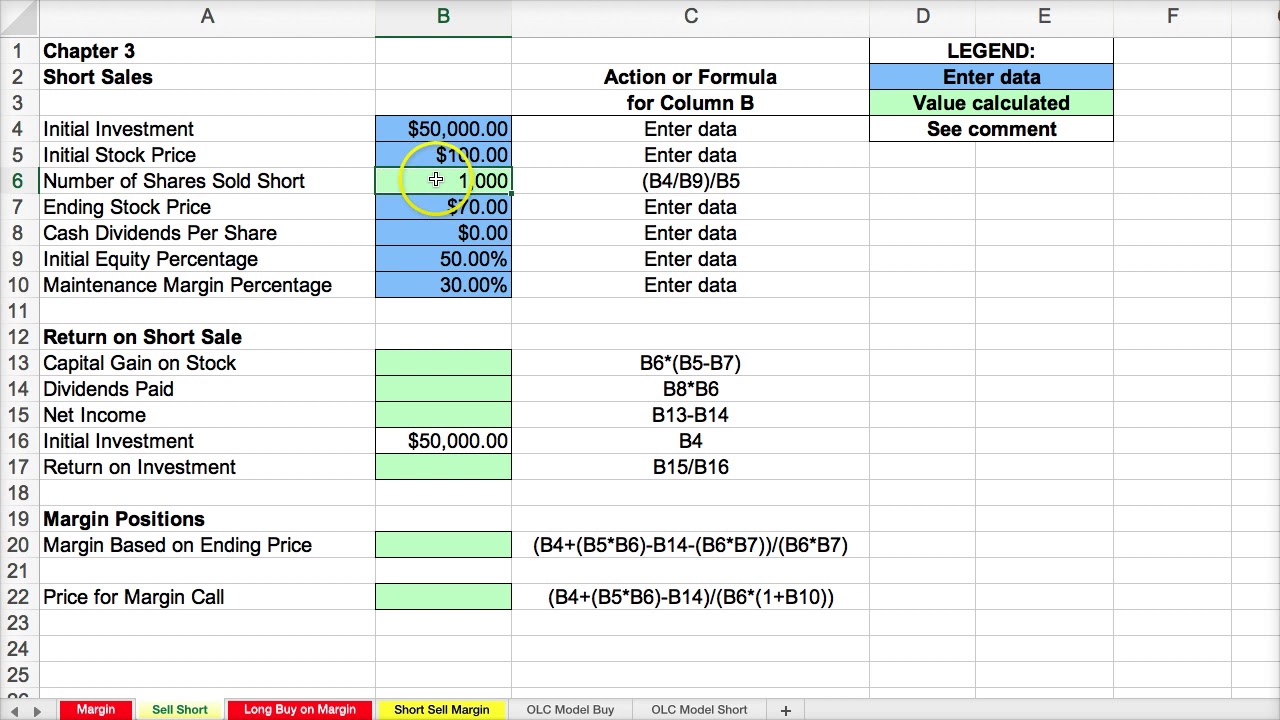

To calculate the return on a short sale first determine the difference between the sale proceeds and the cost associated with selling off the position. Margin rates as low as 283. An investor borrows 100 shares of XYZ stock currently trading at 35 per share and paying a 4 dividend and sells it short.

The margin requirement would be. Example 1 Profits and Losses from Selling Short. The Zerodha FO calculator is the first online tool in India that lets you calculate comprehensive margin requirements for option writingshorting or for multi-leg FO strategies.

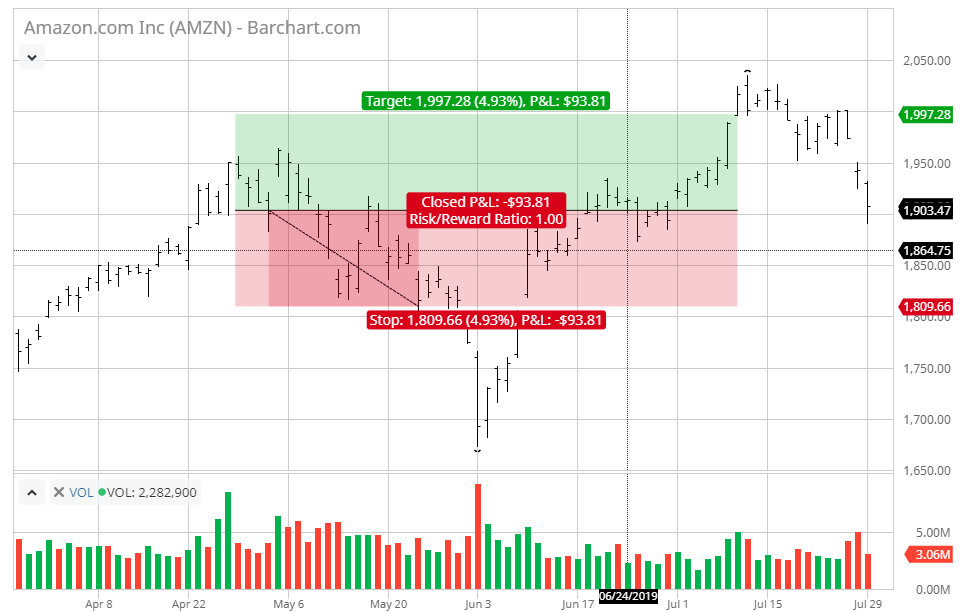

Rates subject to change. Purchase 1000 shares of a stock at 50 with margin rate of 30. View any positions current margin requirements calculate the impact of hypothetical trades and see how price changes can affect your margin requirements and.

Margin borrowing lets you leverage securities you already own to purchase additional securities sell securities short protect your account from overdraft or. This is the minimum. You sell short 1000 shares XYZ stock for 10 per share.

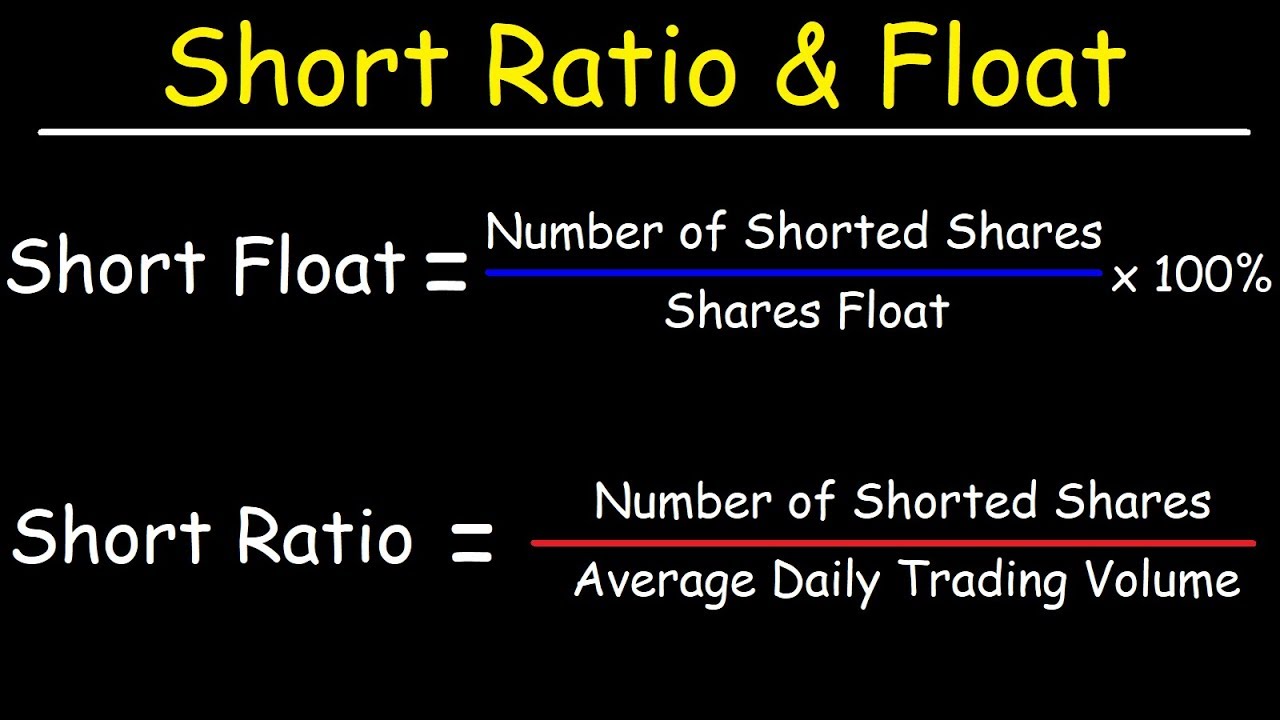

1000 shares x 50 x 30 margin rate 15000. Calculating the Current Margin and Equity of a Short Sale. Profit margin is the amount by which revenue from sales exceeds costs in a business usually expressed as a percentage.

Margin rates as low as 283. A margin call is a broker demand requiring the customer to top up their account either by injecting more cash or selling part of the security to bring the account to the required. Margin and Selling Short.

Simple Stock Short Selling Profit And Loss Calculator

Interactive Charts Long Or Short Position Calculator Barchart Com

Margin Call Price Formula And Calculator Excel Template

Margin Call Price Formula And Calculator Excel Template

Pin On Products

Maintenance Margin Formula And Example Calculation

Forex Calculators Margin Lot Size Pip Value And More Forex Training Group

Excel Margin And Short Sell Calculations Youtube

Most Shorted Stocks Financhill Investment Advisor Financial Advice Securities And Exchange Commission

How To Calculate The Short Ratio Short Float Number Of Shares Shorted Youtube

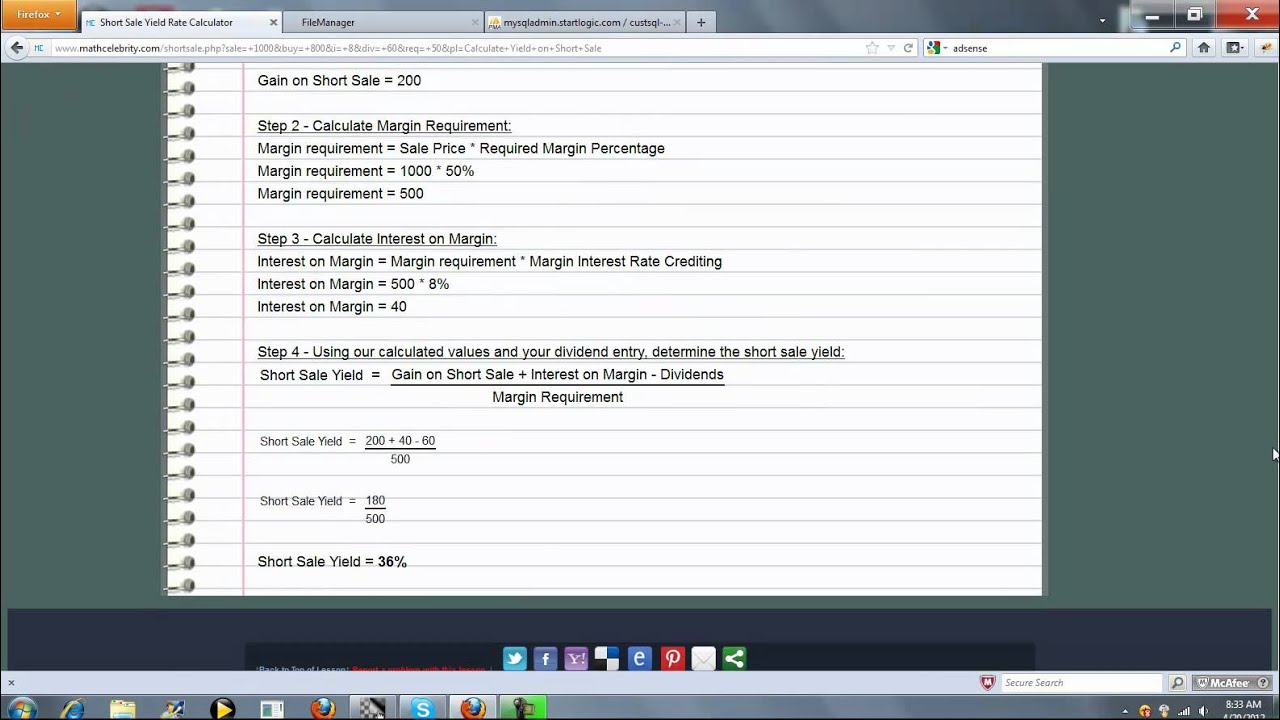

Short Sale Yield Rate Calculator

Margin Call Price Formula And Calculator Excel Template

2nd 3rd Grade Word Work Short Vowels Google Classroom Distance Learning 3rd Grade Words Word Work Blends Word Work

Hp 12c Financial Calculator Financial Calculator Calculator Financial

Cagr Calculator For Stocks Index Mutual Funds Fd Calculate In 3 Easy Steps Financial Instrument Mutuals Funds Systematic Investment Plan

Margin Call On Short Sale Youtube

Plate Cost How To Calculate Recipe Cost Chefs Resources Food Cost Catering Food Recipe Template